.png?width=770&name=Pet%20webinar%20learnings%20(1).png)

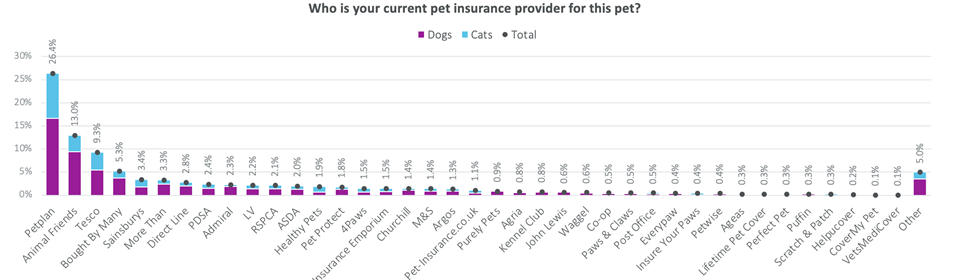

1. The market is dominated by just a few brands

Unlike the home and motor market, the pet insurance market is dominated by just a few brands. But what that could mean is opportunity – and we’ve seen Bought by Many come onto the scene fairly recently and take fourth place in terms of market share.

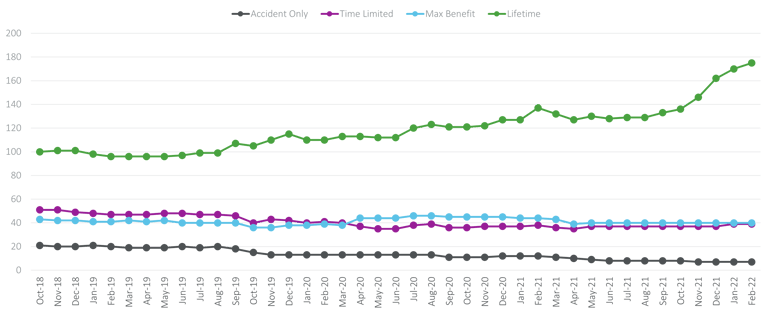

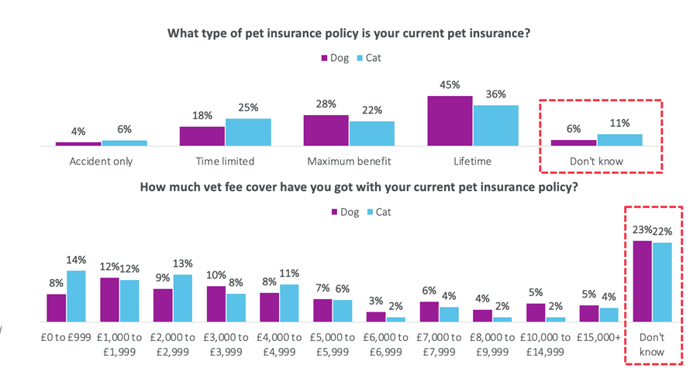

2. Lifetime products are the most popular

Lifetime products have always been the most popular, but that popularity has increased recently – reflecting the influx of pandemic pets.

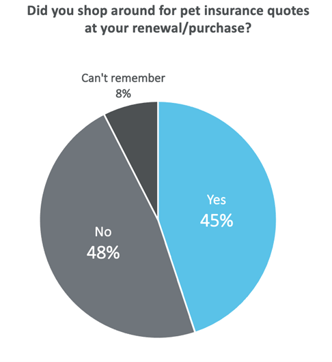

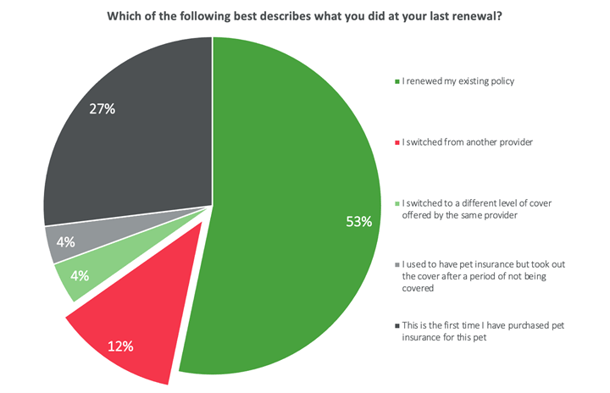

3. Pet insurance policyholders don’t shop and switch

Only 45% of people shopped around for their pet insurance policy, compared to 81% of motor and 74% of home customers.

And people aren’t switching either. Only 12% switched at their last renewal – reflecting how difficult it is to change providers, especially if your pet is older or has pre-existing conditions.

That not only makes the initial point of sale crucial for brands to get right – but could also present an opportunity for new product offerings that could provide more options for older or rescue pets.

As reality bites for many lockdown-pet-purchasers, rescue centres are predicting 77% of pandemic pups will be returned this year. 91% of people said they’d consider a rescue animal – and insurance firms could grab market share by making it easier to insure them.

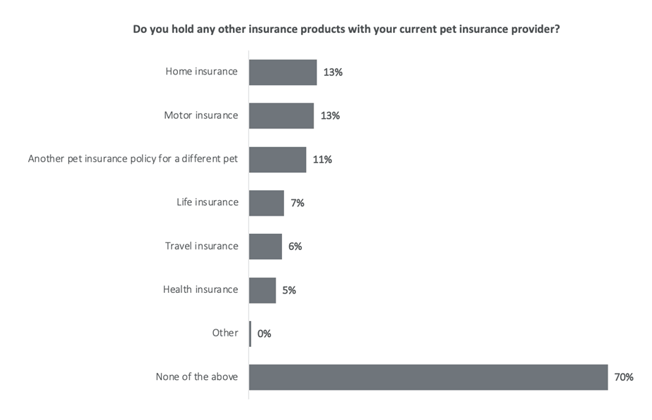

4. Cross-selling isn’t happening

There doesn’t seem to be a lot of cross-selling when it comes to pet insurance. That’s partly because many brands don’t do other personal lines. The most cross-selling synergy is found with home insurance products – insuring the home and animals that live there.

5. People don’t know what they’re covered for

People are very clearly not understanding their policies or their cover. 6% of dog owners and 11% of cat owners didn’t know what type of policy they had, and nearly a quarter of both dog and cat owners had no idea how much vet fee cover they actually had.

6. The uninsured are uninsured because they think they can afford it – or because they know they CAN’T afford it

People who have the insurance don’t understand it, but perhaps more worryingly people without it maybe don’t understand why they might need it – or exactly how much vet fees might actually add up to.

The top reason people cited for not having pet insurance was that they could cover the cost of vets fees themselves if anything happened to their pet. The next reason was that they couldn’t afford the (usually significantly smaller) premium.

7. Un-insurance could be the sector’s biggest challenge

With the costs of living sky-rocketing, it’s likely pet insurance could be one monthly expense consumers choose to cut. Brands need to act now to demonstrate the true value of their products, showcase potential risks and treatment costs, and provide stripped-out basic product options.

8. Fair value is coming

The FCA principles of fair value and customer duty apply to pet insurance just as much as home or motor – and it’s likely to come under increasing regulatory scrutiny. Whether or not, for instance, the current American-health style system of endorsement and exclusions from vets and breeders will be allowed to continue much longer is up for debate. Intervention and could open up distribution channels and marketing opportunities for brands savvy enough to see the lay of the land – and build value into their pet products and communications.

Communication will be key. It’s clear customers and potential customers aren’t understanding what they’re buying – and therefore can’t make good choices. The FCA puts the responsibility for articulating fair value firmly at the door of insurance brands. Now is the time to take on that awareness and education job.

9. Ian Hughes’ dog has an anxiety disorder

And finally, we learned that poor Tyson does not like to be left alone! However, his anti-depressants ARE covered by his pet insurance, much to Ian’s surprise.

You can watch the full webinar here, or get the data you need to inform your pet insurance strategy in a fast-evolving marketplace from our Pet Insurance Behaviour Tracker.

Take advantage of this booming market, using the new Pet Insurance Behaviour Tracker

Understand the attitudes and buying behaviours of UK pet owners, both insured and uninsured, with the most comprehensive, insurance-focused consumer survey in the market.

Source: www.consumerintelligence.com

.gif?width=771&name=Copy%20of%20Get%20ahead%20in%20the%20pet%20(2).gif)