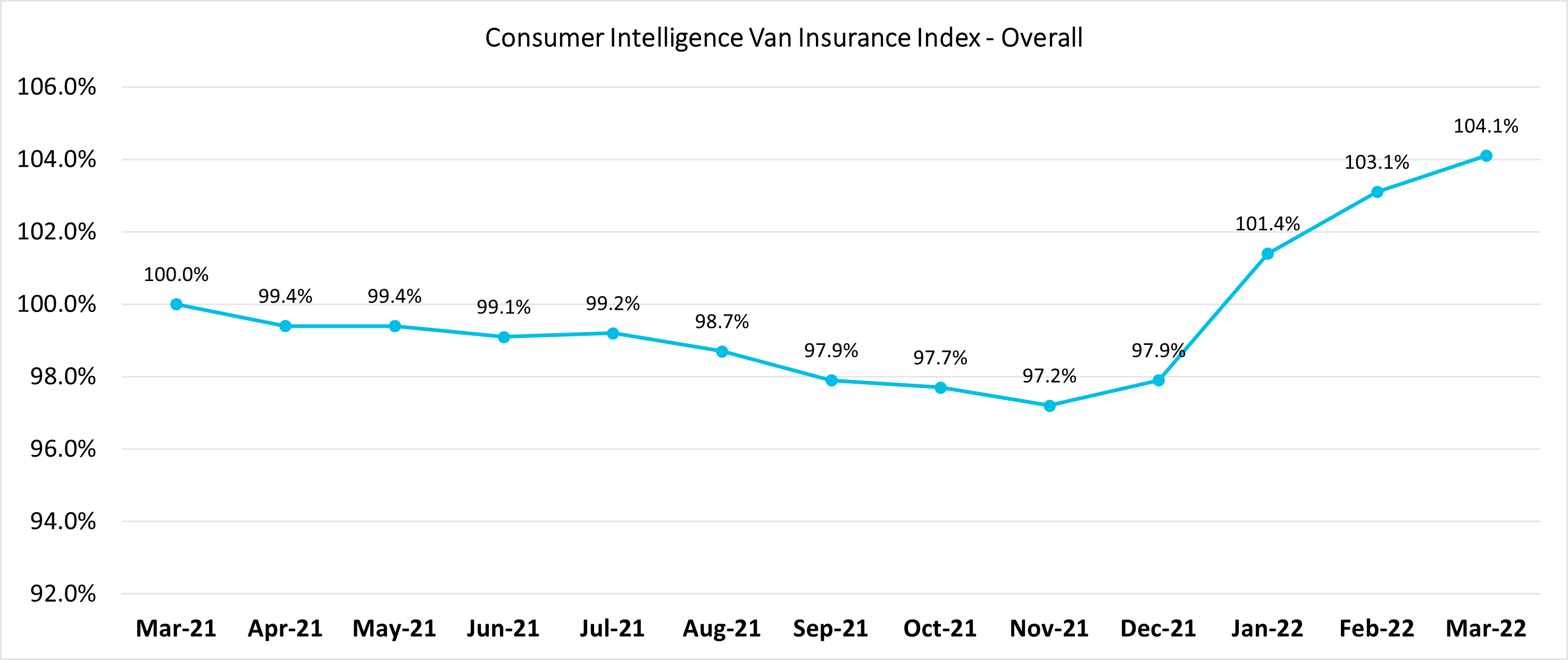

- Van insurance is up 6.3% since the start of the year, as a result of new “price walking” rules that came into force in January.

- The average quoted cost of van insurance in the UK is now £1,135.

- Drivers using their vans for business (£1,145) continue to pay slightly higher premiums than those who use their vans as a car substitute (£1,107).

While 2021 saw the average cost of van insurance fall by 4% from January to December, the first few months of 2022 have told a different story. The FCA’s general insurance pricing rules, which were introduced to put an end to “price walking”, have pushed up premiums by 6.3% in the three months to March, according to the latest research from pricing data experts Consumer Intelligence.

Since January, insurers have no longer been able to offer new customers enticingly low premiums to win their business – with renewing customers only allowed access to the same deals as a new customer. Data from Consumer Intelligence suggests it’s having the effect of reducing the number of cheap deals in the market.

An average annual van policy in the UK now stands at £1,135.

Long-term view

Average premiums have now increased 40.2% since April 2014 when Consumer Intelligence first started collecting data.

Within our age demographics, the bulk of these rises have come from van drivers aged 25-49 and the over-50s, who’ve seen 60.1% and 55.6% price hikes, respectively – whereas the under-25s have witnessed price falls in the region of 23.8% over the same period.

Type of cover

Drivers using their vans for business (£1,145) continue to pay slightly higher premiums than those who use their vans as a car substitute (£1,107) under a ‘social, domestic and pleasure’ (SDP) policy.

Business users have also seen their motor premiums increase 6.8% in the last three months, with premiums rising just 5.0% for those using their vans as a car substitute.

Age gaps

All age groups have recorded broadly similar premium rises in the last three months – with van drivers aged 25-49 (6.4%) seeing prices increase slightly more than for those aged 17-24 (5.9%) and the over-50s (5.7%).

A typical annual policy for a younger van driver under the age of 25 remains prohibitively high at £3,936. For those aged 25-49 an annual premium is now, on average, £835. While for the over-50s, an annual policy costs just £562.

|

Consumer Intelligence Van Insurance Index – Overall |

Date range |

Overall |

Age 17-24 |

Age 25-49 |

Age 50+ |

Carriage Of Own Goods |

SDP |

|

Last year |

Dec 2020 to Dec 2021 |

-4.0% |

-17.8% |

-1.2% |

-3.9% |

-4.3% |

-3.0% |

|

Last 6 months |

Jun 2021 to Dec 2021 |

-1.3% |

-6.7% |

-0.3% |

-0.9% |

-1.9% |

0.5% |

|

Last 3 months |

Sep 2021 to Dec 2021 |

0.0% |

-1.6% |

0.4% |

-0.5% |

-0.5% |

1.4% |

|

Year to date |

Dec 2020 to Dec 2021 |

-4.0% |

-17.8% |

-1.2% |

-3.9% |

-4.3% |

-3.0% |

Insight that will enable you to optimise your pricing strategy

Our insurance price benchmarking service will help you understand the daily movements of your competitors and help you to quickly identify pricing changes you need to make.

Source: www.consumerintelligence.com