Having been starved of foreign travel over the pandemic, the Great British Holiday Maker is ready and raring to dust off their suitcase and whip out their passport – despite the rising the cost of living.

Consumer Intelligence’s Karen Houseago told the audience at the International Travel & Health Insurance Conferences (ITIC) last week that the holiday is very much back – and what’s more, travellers are increasingly looking for back-up…

Here are the key points from her presentation.

The holiday is sacred

69% of Brits in a recent Viewsbank survey of 1,000 consumers told us they haven’t been on holiday since before the pandemic started. That number was flipped on its head when we asked about travel plans – with 68% saying they were now planning on going abroad in the next 12 months.

And there’s some real determination behind those plans. We may be emerging from a global pandemic, but we are also plunging straight into a climate of economic uncertainty. Despite the rising cost of living, the holiday remains sacred.

15% of people told us a holiday is definitely on the cards in 2023 and that money wasn’t an issue. A further 34% said that despite financial pressures, they would be doing anything they possibly could to save for a 2023 holiday.

Travel insurance is in demand

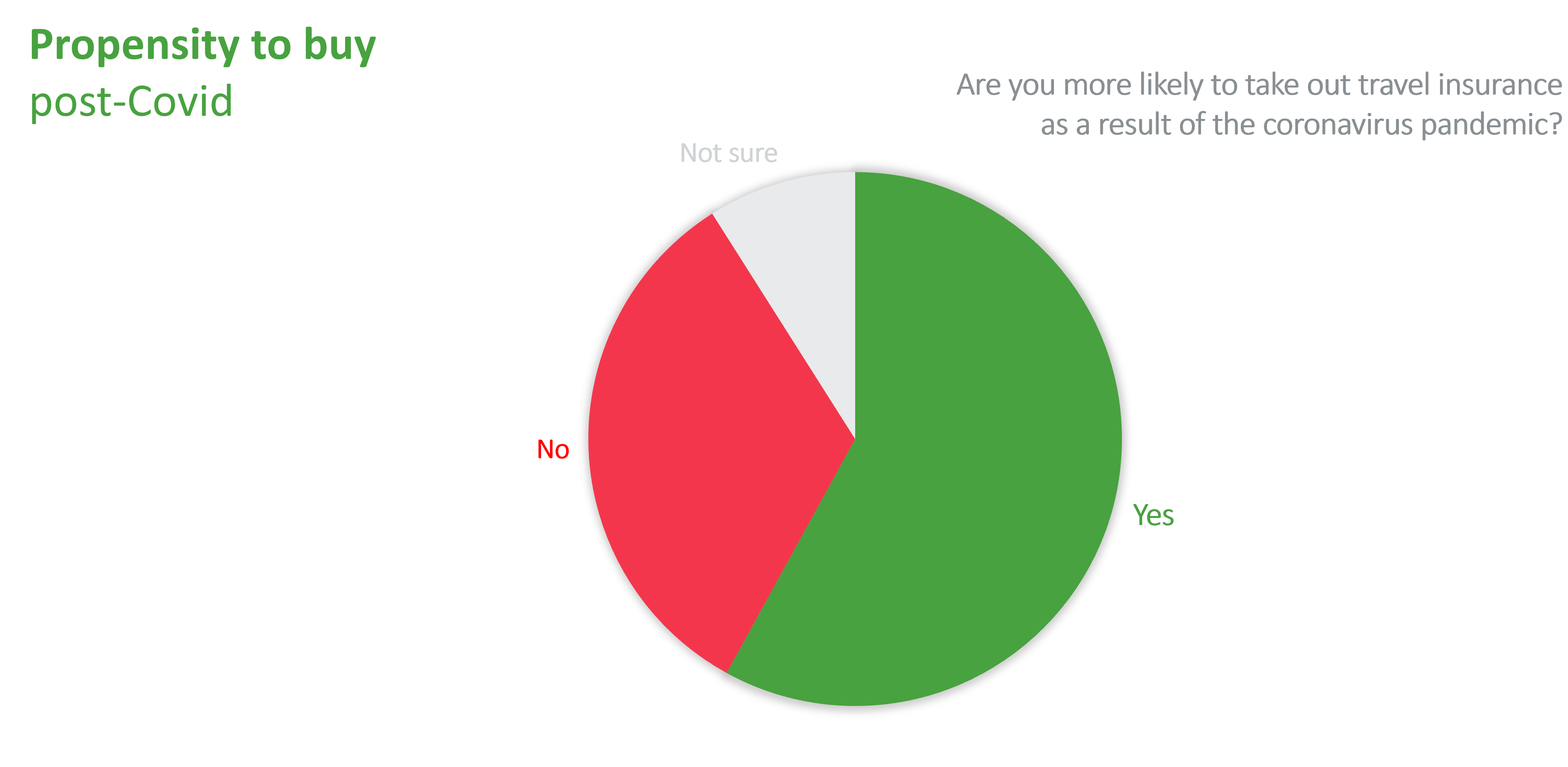

The pandemic has made people more likely to take out travel insurance than before. 58% of Brits told us they’d be more likely to do so, with a further 9% saying they weren’t sure.

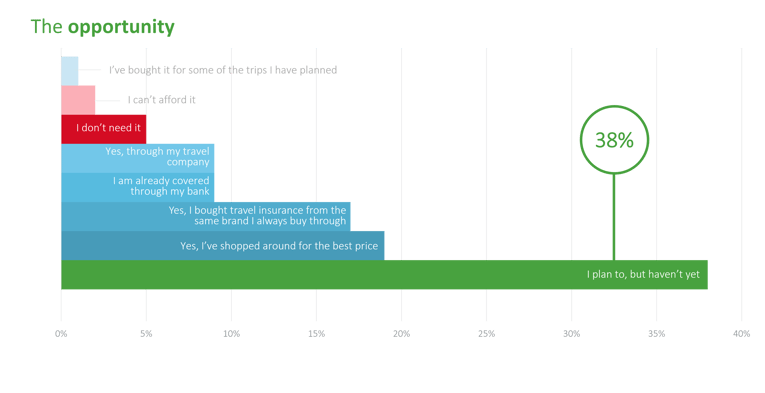

In fact, only 7% of people with a holiday booked in the next 12 months told us they wouldn’t be getting travel insurance, either because they can’t afford it or don’t think they need it.

Most interestingly, 38% told us they planned to get a travel insurance policy but hadn’t bought one yet – which means there’s considerable volume in the market for suppliers to go after. But how should they target them?

It’s not all about price – and Covid cover matters

Unlike home and motor insurance, travel insurance consumers are not price driven. When we looked at purchase drivers, price took third place behind a recognisable and trusted brand – and quality of the cover itself.

Firms recognising the opportunity in the 2023 travel resurgence need to think about how to woo customers who are seeking reassurance over a bargain.

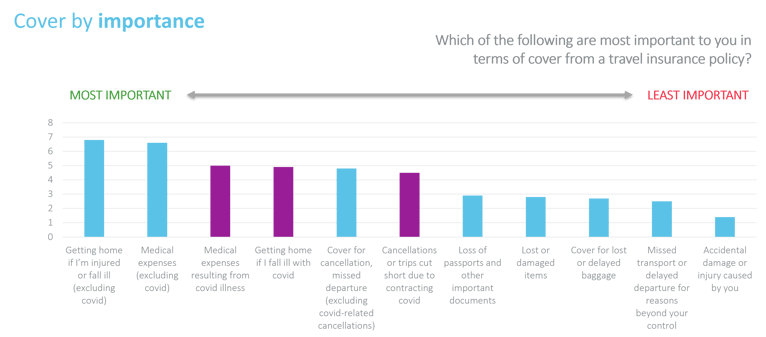

Many holidaymakers may have been bitten by – or at least made aware of Covid-related travel problems. We found people placed more importance on Covid cover features than the majority of traditional features of a travel policy.

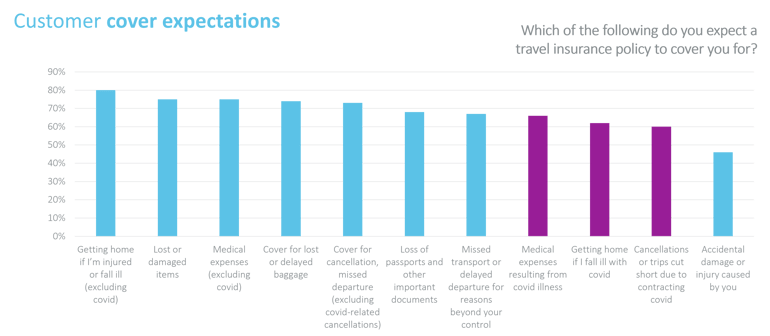

However, expectations around Covid cover were low. Most consumers don’t seem to expect Covid cover to be included over and above traditional cover… and that could be part of the opportunity.

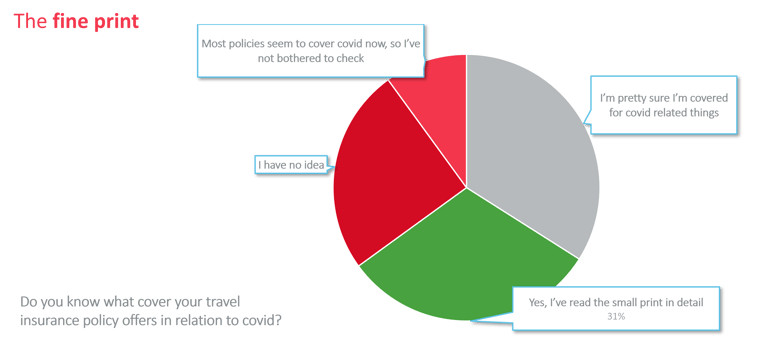

Customer understanding could be improved

Overall, it seems that customer’s understanding of travel policies can vary widely – by their own admission.

We found that a quarter of people admitted to having no idea of what cover their travel policy gave them, with 44% essentially ‘hoping for the best’, and only 31% confident they’d read the fine print of their policy inclusions and exclusions.

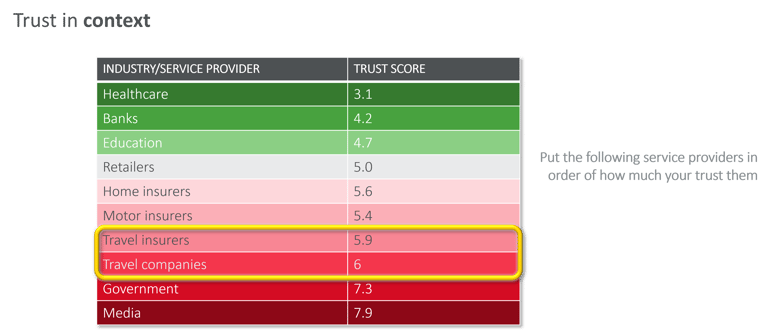

Trust is key

There’s clearly something of an education job to be done as part of anyone’s marketing strategy – and perhaps the biggest opportunity of all is the opportunity here to build trust.

Travel insurance historically has not fared well in the courts of public opinion. In fact, its trust score comes towards the bottom of the insurance league table…

But it’s here that the pandemic and its associated travel issues may have done the sector some weird favours – because our Viewsbank shows rising trust in travel insurance.

79% told us they trusted their travel insurance provider to pay out in the event they had to make a claim, and 88% said they believed the level of cover their policy offered was fair in relation to what they paid for it.

In conclusion, travel insurance is a dynamic sector right now. There are more holidays on the horizon, more interest in travel insurance, more trust, and more information and explanation clearly needed.

Now it’s up to the sector to rise to the challenge, meet demand – and exceed expectations.

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Source: www.consumerintelligence.com